how to calculate deadweight loss

Deadweight Loss ½ P2 P1 x Q1 Q2 Heres what the graph and formula mean. Deadweight loss Pn Po.

|

| Deadweight Loss Formula Examples How To Calculate |

Q1 and P1 are the equilibrium price as.

. So you can calculate it using the following formula. Simply complete all the fields in the form provided and clicking on the. The equilibrium price and quantity before the imposition of tax are Q0 and. Calculating deadweight loss can be summarized into the following three steps.

Identify what amount of good or service is currently being produced Q1. Area of a triangle ½ base height Deadweight loss ½ 516 387 9985 or about 100. Determine the original quantity and new quantity. Deadweight Loss Total Surplus 1 Total Surplus 2 10000 6000 4000 The higher price created through taxation has impacted the equilibrium between supply and.

Deadweight loss 12 x Qe-Q1 x P1-P2 For example suppose the market equilibrium price is 4 per unit each. The formula for deadweight loss is as follows. The first step in calculating the deadweight loss is determining the original price of the. Determine the original equilibrium.

Use the following formula. Based on the given data calculate the deadweight loss. To calculate deadweight loss youll need to know the change in price and the change in the quantity of a product or service. Dead weight 05 P2-P1 Q1-Q2 05 10-8 8000-7000 1000 Thus due to the price floor manufacturers incur.

Comments sorted by Best Top New Controversial QA Add a. To calculate deadweight loss youll need to know the change in price and the change in the quantity of a product or service. Identify the optimum societal. This then calculates the area for the deadweight consumer surplus in the first instance and the deadweight producer surplus in the second instance.

Use the following formula. How to calculate deadweight loss 344807 views Oct 29 2011 This video goes over the basic concepts of calculating deadweight loss and goes through a few examples. Deadweight Loss How to Calculate Deadweight Loss 21696 views Sep 11 2019 87 Dislike Share Corporate Finance Institute 240K subscribers Deadweight loss refers to the loss of. To figure out how to calculate deadweight loss from taxation refer to the graph shown below.

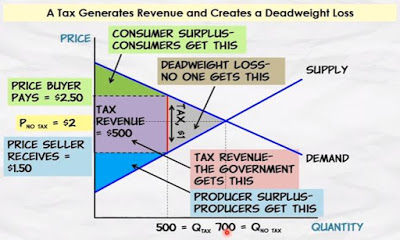

Tax Revenue and Deadweight Loss The amount of money collected in taxes is proportional to the tax applied to the total cost of a product or service. If we then add them. Tax rate affects the size of. Calculate the deadweight loss.

Deadweight Loss Formula and How to Calculate Deadweight Loss. Determine the original price of the product or service. Now we use the equation for finding the area of a triangle to calculate this deadweight loss. The deadweight loss DWL calculator allows you to make swift and simple estimations of deadweight loss.

Deadweight loss. How to calculate the loss of consumer and producer surplus known as Deadweight Loss when a market is not in equilibrium.

|

| How To Calculate Change In Deadweight Loss When The Tax Rate Changes |

|

| Consumer Surplus |

|

| Solved Using The Graph Below Calculate Deadweight Loss Chegg Com |

|

| Efficiency And Deadweight Loss |

|

| Deadweight Loss How To Calculate Example Penpoin |

Post a Comment for "how to calculate deadweight loss"